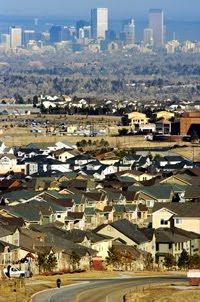

I was going to chime in on Bryan Caplan's post on whether government policies have encouraged or discouraged more suburbanization when I noticed a commenter had already stated all of my counterpoints. Two additional obvious points regarding federal policies are the home mortgage tax deduction (encourages more house consumption) and the Interstate Highway System (encourages more driving and decentralization).

One thing missing that I'd like to see is the geographic distribution of government funding. My assumption is that cities get the lion's share of research grants (via universities) and transportation dollars (via public transit authorities), but remember that they also represent the lion's share of population, jobs, and economic activity. Can anyone point me to a fair, reasoned exposition of where the money goes, to see if cities are underfunded or overfunded compared to suburbs?

4 comments:

That's the kind of thing I might think of asking you, Lee! :-) I definitely want to have a much fuller and detailed picture of just what is going on economically in our region. What percentage of the money flowing into our region comes from the state governments of PA, NJ and DE? How much from the U.S. government? Do those amounts (for states and feds), against taxes paid out, represent a net inflow, or net outflow? What would happen if all financial dealings between the Philly region and the state and federal governments, ceased tomorrow? Etc.

I'd also like to see multiple maps of all the school districts in the Philadelphia MSA, with different color codings for each district, showing things like:

- Amount of local tax money spent per enrolled student

- Amount of state tax money spent per enrolled student

- Amount of federal tax money spent per enrolled student

- Percent of all school-age children enrolled in district schools

Lower Merion has its 2009-2010 budget available online, so the first three numbers are pretty easy to calculate. (The answer for the local tax question: about $24,000. The amounts from state and federal taxes are much smaller.) I don't know the total number of K-12 age kids in LM, so I can't answer the fourth question.

Compulsory K-12 schooling, plus public school districts funded mainly by local property taxes, is a social disaster.

But you didn't write a post about education political economy, so I'll shut up for now. :-)

Popular conception is that cities are underfunded. However, I'm not sure actual federal dollars going toward suburbanization are as important as policy, finance/lending practices, and, we must never underplay, the consumer preference of Middle America.

FHA finance policy plays a greater role than we give credit. Here, detached housing is seen as less "risky" to finance than a condominium and attached product, so mortgage lending favors single-family. Just that extra effort to get condominium projects FHA-approved discourages developers to provide that, even in the face of mounting demand for such urban choices. The mortgage lending industry is geared to think this way. A lot of this is cultural (you don't have this way of thinking about condos in Britain, for example). But a subdivision is nothing more than a spread out condo building in terms of risk...Look at all the half-built, foreclosure hemorrhaging subdivisions now littering the landscape. The cultural (and spiritual?) obstacles we are facing are great indeed...

Joel, that all would be very interesting to look at. Now if someone will just pay my firm to do it!?! :)

On a related note, one of my bosses, who is very left-leaning, wondered aloud the other day if you did a similar exercise by Democrat vs. Republican parts of the country, say by party registration by county. D's stereotypically seek more income redistribution than R's, and yet my boss ventured a guess that there's currently probably a net positive distribution from D counties to R counties, when you factor in taxes paid and services rendered.

Eric, thanks for this insight. Perhaps we will look back on the great subprime mortgage meltdown of 2007-2009 as a turning point in lending preferences, as a more diverse America and dearer energy prices combine to motivate mortgage providers that dense urban areas are less risky and sprawled-out suburban areas more risky than once considered.

Post a Comment